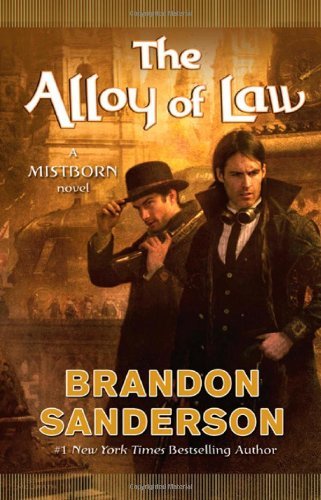

Books I’m Reading

After finishing the Mistborn trilogy by Sanderson I had to try out this first of a sequel series that’s set in the same world. It takes place roughly 300 years after the events of the last Mistborn book, The Hero of Ages. I’m thoroughly enjoying it so far.

From the Goodreads summary:

Three hundred years after the events of the Mistborn trilogy, Scadrial is now on the verge of modernity, with railroads to supplement the canals, electric lighting in the streets and the homes of the wealthy, and the first steel-framed skyscrapers racing for the clouds.

Kelsier, Vin, Elend, Sazed, Spook, and the rest are now part of history—or religion. Yet even as science and technology are reaching new heights, the old magics of Allomancy and Feruchemy continue to play a role in this reborn world. Out in the frontier lands known as the Roughs, they are crucial tools for the brave men and women attempting to establish order and justice.

One such is Waxillium Ladrian, a rare Twinborn who can Push on metals with his Allomancy and use Feruchemy to become lighter or heavier at will.

After twenty years in the Roughs, Wax has been forced by family tragedy to return to the metropolis of Elendel. Now he must reluctantly put away his guns and assume the duties and dignity incumbent upon the head of a noble house. Or so he thinks, until he learns the hard way that the mansions and elegant tree-lined streets of the city can be even more dangerous than the dusty plains of the Roughs.

Video I’m Watching

Lyn Alden’s Broken Money thesis in under 50 minutes:

On Bitcoin (Cycles)

If you know much about Bitcoin, you’re familiar with the “halving.” This is the once-every-four-years preprogrammed 50% reduction in the block reward issued to miners after each new block of transactions are produced (approx. every 10 minutes).

This four-year cycle has produced the predictable booms and busts in the Bitcoin price since the creation of Bitcoin in 2009.

There’s an ongoing debate between the “cycles are dead” crowd on one side and the “cycles won’t go away” crowd on the other side.

There are valid reasons to believe cycles will remain:

- Human nature won’t change. Greed and FOMO drive an increase in leverage leading to overleverage, which eventually drives price toward a “blow off top” and subsequent decline.

- The halving of supply issuance creates a reduction of new supply as described above. If demand increases, remains the same, or even decreases slightly, price must increase, leading to the blow off tops characteristic of the cycles.

- Bitcoin’s price is heavily correlated with global liquidity trends. Loose monetary conditions tend to fuel risk-on assets like Bitcoin, driving bull runs, while tightening triggers sell-offs. These bigger picture liquidity cycles will remain and will continue driving Bitcoin’s cyclical nature.

The cycles are dead side also has valid reasons:

- Companies and nation states are now buying Bitcoin in increasing amounts. Only ~3,150 new bitcoins are entering the market weekly through block rewards. Companies alone are buying >10,000 bitcoins per week—nearly three times the weekly issuance. This represents a constant bid buying up any price dips.

- More states in the USA and nations globally are announcing strategic Bitcoin reserves. These entities, again, represent a persistent bid beneath Bitcoin’s price dips.

- As more countries and jurisdictions explore Bitcoin as legal tender or reserve asset, its role as a stable store of value grows. This shift reduces its sensitivity to speculative cycles.

Ultimately, as adoption is growing, Bitcoin’s volatility is decreasing. The four-year cycles are becoming more muted. This is to be expected.

My opinion is that the four-year cycles will dampen over time and eventually disappear.

Tweets I’m Reading

🌏The MTPLFer's Guide to Moving Strike Warrants🚀

— Compliant Degen (@CompliantDegen) July 3, 2025

The Compliant Degen signal is shining over Gotham City, and I'm here to rescue my fellow investors from the intimidating “moving strikes” of confusion and doubt relating to Metaplanet’s primary capital formation strategy.

In… pic.twitter.com/9R2reUojHi

Sorry, but remember my cube concept?

— ActuallyClimber (@ActuallyClimber) July 4, 2025

X- Bitcoin price change changes the stocks price by the same amount assuming mNAV and btc/share stay the same.

Y- mNAV change affects price the same way, assuming Bitcoin price and btc/share stay the same.

Z- BTC/share change affects price as a simple ratio as well assuming Bitcoin price and mNAV stay the same.

All of this being said, graphs below are cute, but please rationalize them with not just the potential change in Bitcoin price. In order to perform differently relative to Bitcoin, it’s now the area of a 2D surface stretching or compressing with one axis being mNAV change from today (or your baseline) and the other axis being BTC/share change. So, if you expect mNAV to stay flat and BTC/share to 10x its current amount (impossible for Strategy who holds 3% of all Bitcoin and would require holding 30% with zero share dilution in order to 10x btc/share), but if that’s still the naive expectation, that would allow a max outperformance from here of 10x in Bitcoin terms.

“But what about stock buy backs or earning yield in fiat instead of Bitcoin?” As Bitcoin price appreciates (not talking 50% but 1,000%… 10k% and so on) and a companies stack gets larger, yield and the power of buybacks will shrink. Expected double digit % outperformance of Bitcoin will be a thing of the past in coming decades once geo markets are saturated. That’s why now is such a critical time for investors to research and see if anything is worthy of their conviction.

“But mNAV is uncapped if they just stop selling shares on common. Plus, it’s kinda like PE ratio”. Sorry, not uncapped. I disagree with lots of people in this space here, but I’ll try to explain why. Most companies don’t go around selling common shares to the market very often. So why is their price capped? Because they’re unfortunate enough to hold fiat instead of Bitcoin on their balance sheet? Give me a break 😅. Look, we all know Bitcoin will outperform fiat long term, but it is the Bitcoin per share yield which provides tangible outperformance of the underlying. You think MSTR can reach 5% of all Bitcoin (holding 1.05 million of those puppies?). Great, I do too. So, once they do, if their mNAV hit 20 they would have a market cap equivalent to the value of all 21 million bitcoin. If you still think that’s a rational and even likely outcome, consider why investors would bid it up so high. The goal and potential of MSTR and others to outperform Bitcoin has to be quantified in BTC/Share. Otherwise it’s similar to a Bitcoin ETF. Is IBIT trading at a premium because it holds 600k (or whatever amount) Bitcoin? Nope. Why? Sure, by design, but don’t fall back on it not being an operating company etc. the differentiator is yield. If Saylor stopped providing yield.. decided they have enough Bitcoin and they’ll just squat on it, you think mNAV of 1 isn’t the general result? We’ve seen mNAV below 1 (where they certainly weren’t selling new shares to the market).

“But Climb, that was during a bear market”. Ok, so every bull market MSTRs mNAV can go unchecked to 100 and we will just drop 90-99% or so during bear markets?

“But Climb, there won’t be any more bear markets”. Sirs and ladies, can humans still leverage and overextend themselves? Is margin trading still possible? Is individual collateralized debt still possible? Yes. Human greed makes pops and flops of volatile sectors a “when not if” phenomenon.

Want a short thread of things which will keep mNAV from hitting 100 for anything that has more than a handful of Bitcoin and is trading on hope with extremely low marketcap anyway? 🧵 👇pic.twitter.com/placeholder

This is my convo with @WClementeIII

— Pahueg (Less Noise More Signal) (@pahueg) July 3, 2025

We talk about:

-Why the US is in full ponzi mode

-When will Musk return to Bitcoin

-Why pay attention to the alts market right now

-What crypto equities to look at

-What the life as a Crypto KOL is REALLY like

It‘s good to see you back in… pic.twitter.com/PRlOgKSyTp

@asjwebley on CNBC this morning! pic.twitter.com/ZNJn9yhjYg

— Nick (@BitcoinBee21) July 3, 2025

I was tired of being asked by my friends if something they were buying was a good deal, so I vibe coded a Chrome app that could do it for them.

— Paul Kats (@PauleKats) July 3, 2025

Check out Sweet Dill and let me know what you think! (link in bio)

Why I did it 🧵 pic.twitter.com/YjD34sAUUP

If you have feedback for me, if something resonates and you want to see more of it, reply in the comments below. You can also tweet at me on Twitter @the_cody_hall.

I look forward to hearing from you!

If you’re not yet subscribed you can do so here: