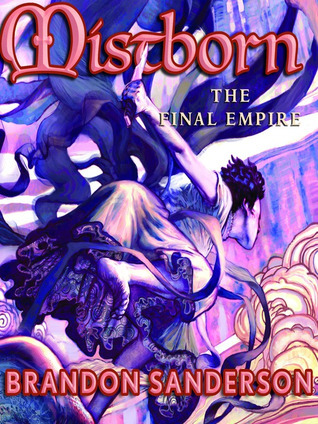

Book I’m Reading

I’ve been chugging through the audiobook edition of Brandon Sanderson’s first book in the Mistborn series. It comes highly recommended by my brother and I have to say, it is great.

Sanderson has created an interesting world with novel physics and dynamics that flow from them. The character development is great and there have already been a couple of twists. I certainly recommend this one.

Podcast I’m Listening To

Here’s another excellent conversation from Lex Fridman.

Marc Andreessen is one of the best tech investors of all time, and the firm he co-founded, Andreessen-Horowitz, has backed some of the biggest tech companies operating today.

Articles I’m Reading

Goodbye, Golden Handcuffs: Inside The Partner Exodus Rippling Across Venture Capital (Forbes)

9 Powers of Satan That Are Not Ultimate (Crossway)

On Bitcoin

Here’s a recently released paper from the Journal of Risk and Financial Management: “A Supply and Demand Framework for Bitcoin Price Forecasting.”

The authors have developed “a flexible supply and demand equilibrium framework that can be used to develop pricing models to forecast Bitcoin’s price trajectory based on its fixed, inelastic supply and evolving demand dynamics.”

Their conclusions are fascinating:

“Our findings indicate that institutional and sovereign accumulation can significantly influence price trajectories, with increasing demand intensifying the impact of Bitcoin’s constrained liquidity. Forecasts suggest that modest withdrawals from liquid supply to strategic reserves could lead to substantial price appreciation over the medium term, while higher withdrawal levels may induce volatility due to supply scarcity. These results highlight Bitcoin’s potential as a long-term investment and underline the importance of integrating economic fundamentals into forward-looking portfolio strategies.“

Tweets I’m Reading

1/ NEW BLOG: "How To Keep The #Bitcoin Strategic Reserve From Morphing Into A Bailout Fund." Did you know SBF publicly advocated for a crypto bailout fund just 1 month before FTX failed? Story 👇Lesson: don’t let future Sams hijack the SBR for a bailout!!!https://t.co/CJ6OOpAotA

— Caitlin Long 🔑⚡️🟠 (@CaitlinLong_) January 29, 2025

MicroStrategy’s unorthodox capital strategy now includes preferred equity: $STRK. It’s a bold play for the holy grail: to harness $MSTR volatility w/o dilution. Whether it succeeds depends on time horizon.

— Jeff Park (@dgt10011) January 28, 2025

Here’s my theory—and why I’m bullish on STRK (hint: it’s less about BTC): pic.twitter.com/QxMibvKAtA

LIVE –> Tulsi Gabbard Senate Confirmation Hearing to be Director of National Intelligence https://t.co/F0011ia51X

— CSPAN (@cspan) January 30, 2025

In December, I made a couple of trips to Miami to sit down with Michael Saylor and dissect the $MSTR phenomenon: a 60x-plus valuation surge in four years, tens of billions raised through equity and zero-interest bonds, and volatility so high bond traders are apparently feeling… pic.twitter.com/3uOF9utfym

— Nina Bambysheva (@ninabambysheva) January 30, 2025

For the first time in nearly 2 years, the bitcoin network is running out of pending transactions to fill up new blocks.

— Tom Honzik (@tom_honzik) January 31, 2025

It's looking like it could happen within a few hours (only 6 block backlog). You can watch in real time here: https://t.co/9GXHzkuTTm pic.twitter.com/3ud1Z2DbuY

If you have feedback for me, if something resonates and you want to see more of it, reply in the comments below. You can also tweet at me on Twitter @the_cody_hall.

I look forward to hearing from you!

If you’re not yet subscribed you can do so here: