Books I’m Reading

This week I finished this audiobook and immediately borrowed #6 via Libby.

Pierce Brown’s work in the Red Rising series is well worth the investment of time to read them.

Podcast I’m Listening To

Here’s another good episode from Lex Fridman. This guy cranks out high quality content regularly.

This one is a discussion with Dave Plummer, a programmer, former Microsoft software engineer (Windows 95, NT, XP), creator of Task Manager, author of two books on autism, and host of the Dave’s Garage YouTube channel, where he shares stories from his career, insights on software development, and deep dives into technology.

On Bitcoin

River is the exchange I recommend people use to purchase their Bitcoin. If you’d like to open an account, you can use this link: https://river.com/signup?r=PLPY3QSX

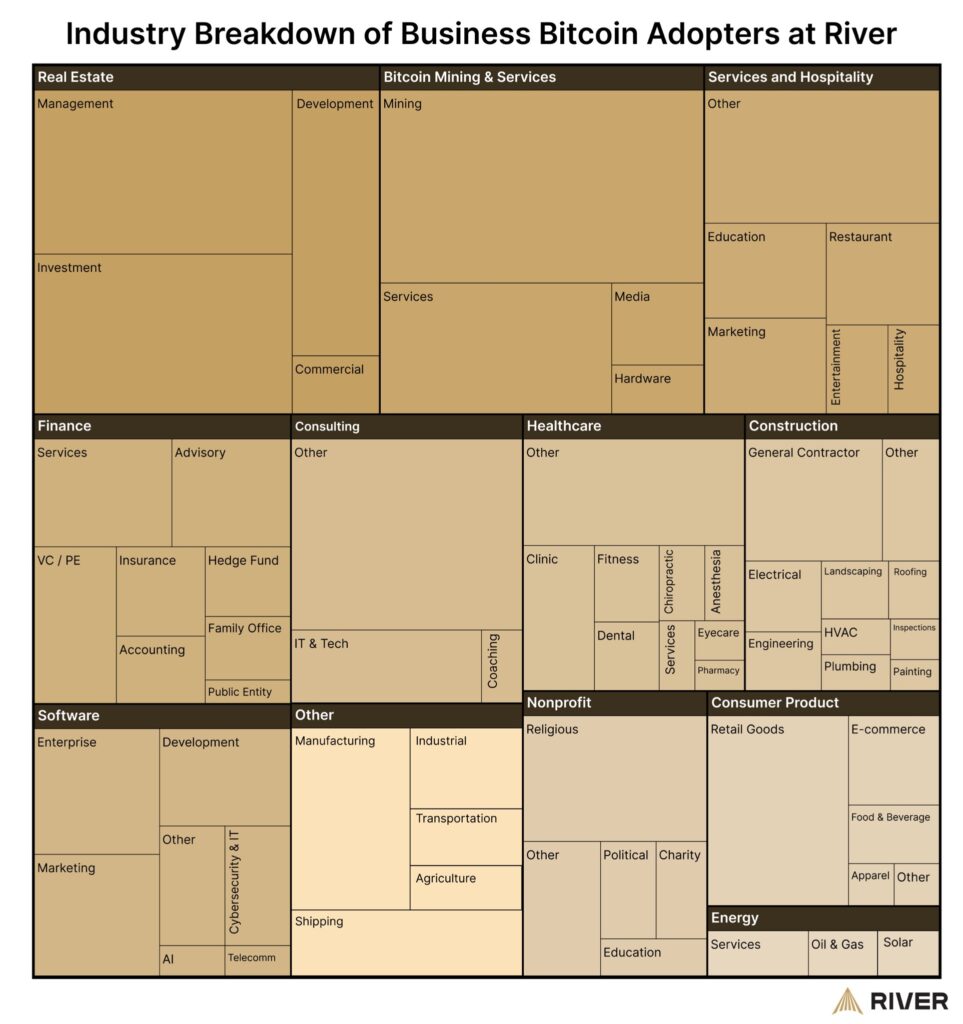

River put out an excellent report this week on various metrics they’re seeing among business clients of River. They’re observing the following:

- Unprecedented Growth in Business Bitcoin Inflows: In the first eight months of 2025, bitcoin inflows onto business balance sheets exceeded the total for all of 2024 by $12.5 billion, reaching $43.5 billion compared to $31.0 billion in 2024. Businesses now collectively hold over 6% of the total bitcoin supply, a twenty-one-fold increase since January 2020, driven by improvements in accounting standards, regulatory clarity, and institutional acceptance.

- Diverse Adoption Across Business Types: Bitcoin adoption is not limited to bitcoin treasury companies, which account for 76% of business purchases since January 2024 and 60% of publicly reported holdings. Conventional businesses across all sectors, including real estate, finance, and healthcare, are also adopting bitcoin, with River serving over 3,000 business clients in the U.S., and 75% of these having fewer than 50 employees, indicating early adoption by small and medium-sized enterprises.

- Bitcoin as a Preferred Treasury Asset: Businesses are increasingly choosing bitcoin to retain earnings due to its inflation resistance, enhanced liquidity (available 24/7), and protection against counterparty risk, as demonstrated by the 2023 Silicon Valley Bank collapse. River’s data shows businesses allocate an average of 22% of net income to bitcoin, with 64% viewing it as a long-term investment, and nearly one-third holding the majority of their treasury assets in bitcoin.

Tweets I’m Reading

For my mobile readers:

— Jeff Park (@dgt10011) September 2, 2025

The Fall of the Intelligent Investor and the Rise of the Ideological Investor

Benjamin Graham’s Intelligent Investor is often treated as timeless. But in truth, “intelligent investing” has always rested on the assumptions of a particularly narrow…

Breakthrough Prayers at SonSet Solutions

— SonSet Solutions (@SonSetSolutions) September 3, 2025

As a ministry, we believe in the power of prayer. God works through prayer and changes our hearts to align better with His heart.

We are actively praying three breakthrough prayers in our regular prayer rhythms as a staff. 👇

~40% of daily code written at Coinbase is AI-generated. I want to get it to >50% by October.

— Brian Armstrong (@brian_armstrong) September 3, 2025

Obviously it needs to be reviewed and understood, and not all areas of the business can use AI-generated code. But we should be using it responsibly as much as we possibly can. pic.twitter.com/Nmnsdxgosp

Trailblazer of the #bitcoin treasury strategy John Fakhoury @PayItForwardDad is joining us to reveal his winning playbook.$MSTR $MTPLF $BTC $BTCTChttps://t.co/C3e9Ymxzzb

— BitcoinTreasuries.NET (@BTCtreasuries) September 4, 2025

FULL INTERVIEW: Palantir CEO Alex Karp on short sellers, his training routine, conspiracy theories & advice for young people. pic.twitter.com/UYdDn9IYIF

— TBPN (@tbpn) September 4, 2025

If you have feedback for me, if something resonates and you want to see more of it, reply in the comments below. You can also tweet at me on Twitter @the_cody_hall.

I look forward to hearing from you!

If you’re not yet subscribed you can do so here: