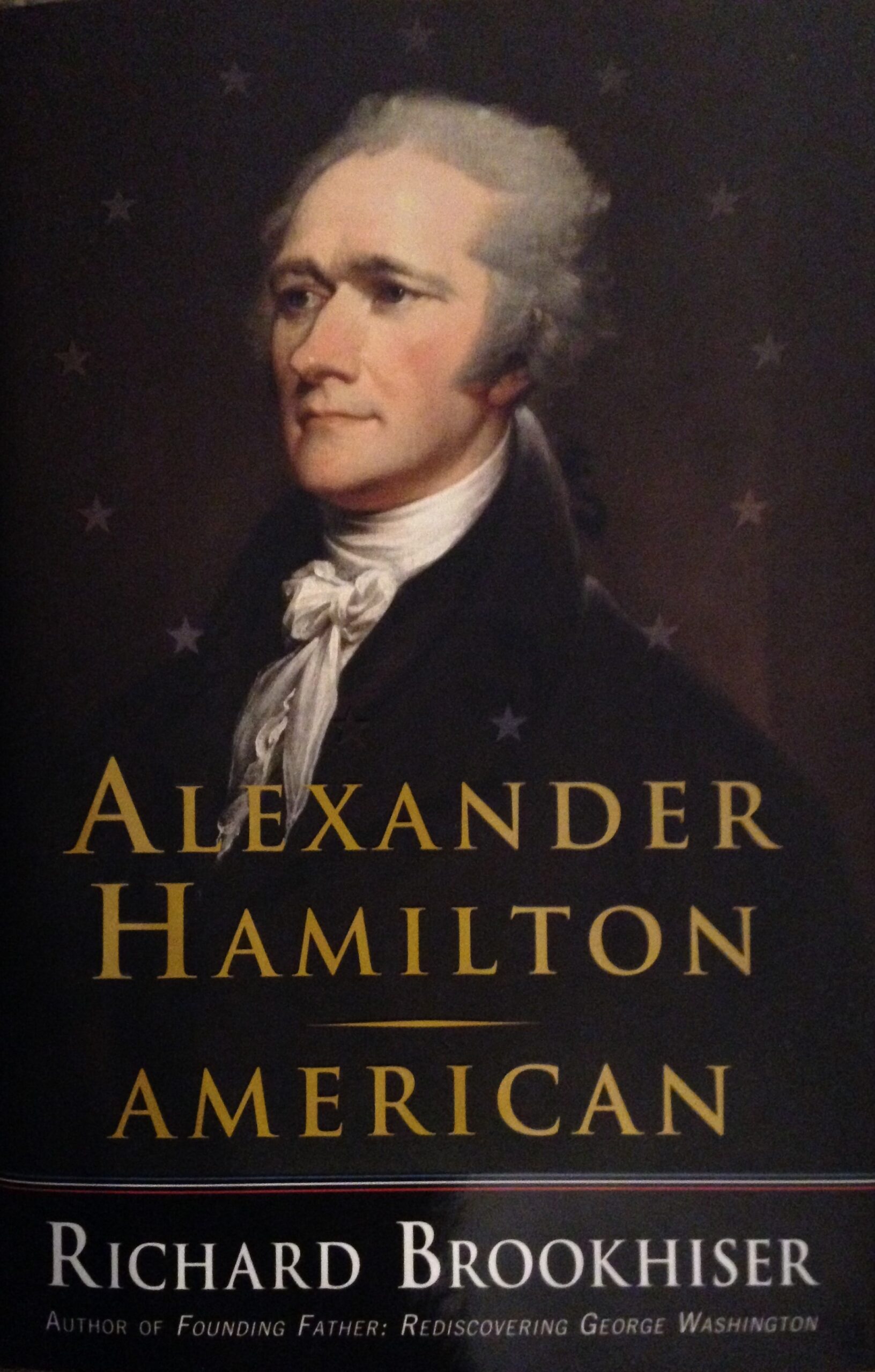

Books I’m Reading

Brookhiser has done good work in writing biographies on several founding fathers of the United States. After finishing Give Me Liberty last week, I started in on Alexander Hamilton, American. It has been great so far.

Hamilton, like so many of the younger founding fathers, excelled in many areas, over and above his peers. He wrote significant works at a young age, entered college at a young age, and read far more than those around them.

He served as one of George Washington’s aides for four years in the Revolutionary War, helped craft the United States Constitution, and, as the first Secretary of the Treasury, was the primary architect and advocate for creating America’s first central bank – the First Bank of the United States, which was established in 1791.

On Bitcoin

Both Bitcoin and stablecoins have immense implications for gospel work globally.

Paying your international staff in stablecoins like USDT or USDC protects them from the inevitable debasement of their local fiat currencies.

In many cases, fees associated with stablecoin payments are <10% of the fees they would pay to convert the USD in their bank accounts into local currencies. Rather than 2-5% fees, they’re more like 0.2-0.5%. Reducing the cost of financial transactions reduces the friction inherent in many areas of life.

On the Bitcoin side, larger ministry payments (think capital expenditures, etc.) sent through traditional USD payment channels (international wires, etc.) are subject to increased scrutiny and fees.

Bitcoin allows an individual or entity to transfer value directly to another individual or entity without an intermediary. Think about that.

Settlement is in minutes on the blockchain vs. days on traditional rails and the fees are fractions of a percent.

Tweets I’m Reading

The Vision Pro launched in Feb 2024 for $3,499.

— Opportunity Cost (@OppCostApp) July 23, 2025

That was 0.081 BTC.

Today worth $9,600. pic.twitter.com/tXVeSeR5mq

^ Opportunity cost is real.

BREAKING: BITCOIN TREASURY COMPANY METRICS NOW LIVE!

— Charles Edwards (@caprioleio) July 24, 2025

For the first time ever, track granular analytics on Bitcoin Treasury Companies. Only at Capriole Charts.

Alpha inside. The last charts are insane.

🧵

BREAKING: The US M2 money supply surged +4.5% YoY in June to a record $22.02 trillion.

— The Kobeissi Letter (@KobeissiLetter) July 24, 2025

This marks the 20th consecutive monthly increase and the largest increase since July 2022.

The surge brings M2 closer to the 2000–2025 average annual growth rate of 6.3%.

Additionally,… pic.twitter.com/Xqw3fOh46g

Customers get mad at grocery store prices because they can't see the Fed.

— Balaji (@balajis) July 25, 2025

Investors get happy about rising stock prices because they can't see the Fed.

And everyone is confused about housing prices because they can't see the Fed.

But you can. pic.twitter.com/ALqnbdXbAH

The fact is @Tether_to is helping millions of people around the world

— Jeff Park (@dgt10011) July 24, 2025

Amidst Bolivias most historic election as the ruling MAS party faces collapse after 20 years of dominance, my friend sent me this pic👇

This is what crypto PMF looks like in real life—

The utility is freedom pic.twitter.com/F8IVkfJmJx

If you have feedback for me, if something resonates and you want to see more of it, reply in the comments below. You can also tweet at me on Twitter @the_cody_hall.

I look forward to hearing from you!

If you’re not yet subscribed you can do so here: