Books I’m Reading

I finished this one this week. Brookhiser did good work here.

Alexander Hamilton is a unique study compared to the other founders of the U.S. They all share many characteristics but Hamilton was a bit of an outlier.

For one, he wasn’t a U.S. citizen. He was born on a Caribbean Island. He was orphaned as a child and faced enormous economic hardships: vastly different from a George Washington or Thomas Jefferson. He also took part in one of the earliest sexual scandals (the Reynolds Affair) among public officials in U.S. history. But he came clean in July 1797 in a thorough, 11,000-word pamphlet that shed light on the whole event, clearing his name of charges of corruption (though clearly admitting his moral failure).

He was an avid writer, producing 51 of the 85 essays published in The Federalist Papers (120,000-130,000 words), the Report on Manufacturers (1791) which was between 30,000-35,000 words, and significant reports on the National Bank and Public Credit (both in 1790). These were in addition to the thousands of letters sent over his career (common among the U.S. founders).

He had vision in economics too. As the first Secretary of the Treasury, he championed policies like the assumption of state debts, the establishment of a national bank, and a system of tariffs to promote manufacturing. These ideas clashed with the agrarian ideals of Jefferson and Madison, who favored decentralized power and rural economies. Hamilton’s belief in a strong federal government and an industrial future made him a forward-thinker, but it also alienated him from those who saw his policies as elitist or monarchist.

His military background was also unique, specifically his role as Washington’s aide-de-camp. While many founders served in the Revolution, Hamilton’s role with Washington and his leadership at the Battle of Yorktown showcased his strategic acumen and bravery. Unlike the more diplomatic Benjamin Franklin or the scholarly Madison, Hamilton thrived in high-stakes, action-oriented roles, blending intellectual rigor with a willingness to risk everything for his principles.

On Bitcoin

Bitcoin’s Golden Bull Run: Treasury Companies, Institutions & Macro Analysis w/@caprioleio

$BTC Golden Bull Run: Treasury Companies, Institutions & Macro Analysis w/ @caprioleio $BTC is being absorbed faster than it’s mined.

— Milk Road Macro (@MilkRoadMacro) August 14, 2025

Institutional demand now exceeds supply by 600%.

We share the chart that could front-run the next 100% move.

Tune in to know more

00:00 –… pic.twitter.com/Pa0vRrDymn

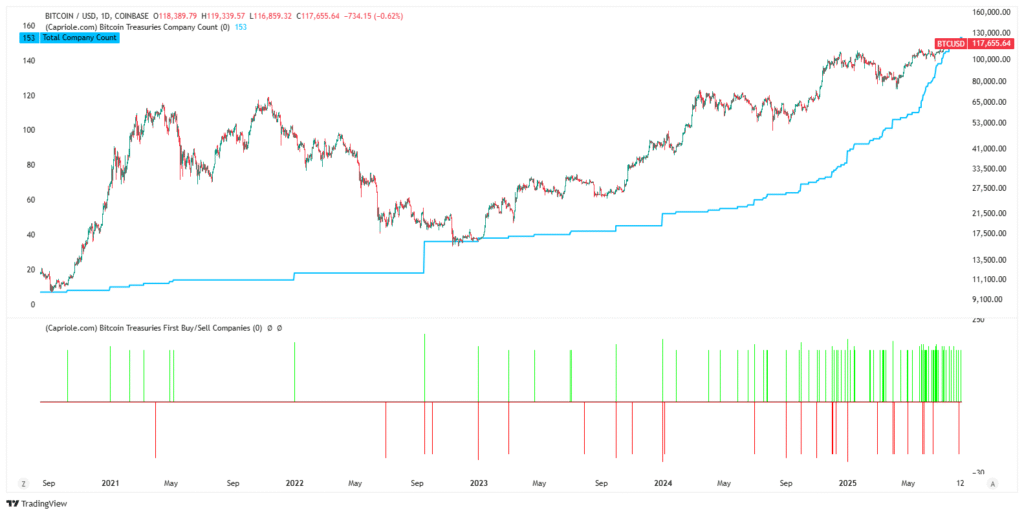

I’ve followed Edward Capriole for a while now. His team built a useful dashboard to track dozens of Bitcoin-related market dynamics, including the recent data points around Bitcoin Treasury Companies and institutional buying of Bitcoin.

This is a space to watch closely.

Think about this: since April 1, every week, institutions have been buying 100-700% of the new Bitcoin mined every week. 3,150 new Bitcoin are mined and issued into the market every week, and 2x-7x that are being purchased by institutions every week.

Edward breaks it down well in the video above, but over 150 publicly traded companies now hold Bitcoin on their balance sheets, up from 60 a year ago. There are numerous tail-winds for institutional Bitcoin adoption right now. Don’t fade this trend.

The blue line below reflects the number of Bitcoin Treasury Companies in the market:

Tweets I’m Reading

Notice the past tense (“remade”).

— Luke Gromen (@LukeGromen) August 13, 2025

Notice the paper in which it was published.

Both massive, flashing signposts.

Let’s watch. pic.twitter.com/apJxhoyp5w

You might be confused by what @protomining just announced today.

— Rob Warren (@BikesandBitcoin) August 14, 2025

What seems like a simple hardware announcement is actually a MASSIVE evolution in how mining farms work from the ground up…

Let's dig in.

1/🧵 pic.twitter.com/BcythMvXie

INTEL: The Fed has officially ended its enhanced scrutiny over crypto activities by withdrawing prior notice requirements and related guidance for banks

— Solid Intel 📡 (@solidintel_x) August 15, 2025

@federalreserve announces it will sunset its novel activities supervision program and return to monitoring banks’ novel activities through the normal supervisory process: https://t.co/GRhepriDhY

— Federal Reserve (@federalreserve) August 15, 2025

I am finally listening to @balajis’ latest podcast with @PeterMcCormack – this has 140K views on YouTube but should be watched by millions.

— Bram Kanstein (@bramk) August 14, 2025

Amazing context and charts on Western decline and great philosophical nudges to understand where the world is going.…

If you have feedback for me, if something resonates and you want to see more of it, reply in the comments below. You can also tweet at me on Twitter @the_cody_hall.

I look forward to hearing from you!

If you’re not yet subscribed you can do so here: