Book I’m Reading

This was a Goodwill find and, wow, is it good! Fast-paced, entertaining, and generous (the authors take liberties) in its character development, this one has kept me on the edge of my seat, even though I know what ultimately happens. That’s good writing.

Podcast I’m Listening To

Articles I’m Reading

Status of Global Christianity 2025 (Gordon Conwell Theological Seminary)

^ Not an article but these are fascinating statistics.

Why A US Bitcoin Strategic Reserve Is Critical To Fending Off China (ZeroHedge)

On Bitcoin

“Volatility is Vitality” – Michael Saylor

Simply put, dead assets have little to no volatility. Assets with the potential to bring outsized returns necessarily have volatility.

You can avoid volatility — it’s easy, buy bonds. Just don’t expect to preserve your purchasing power, let alone keep pace with the rest of the market.

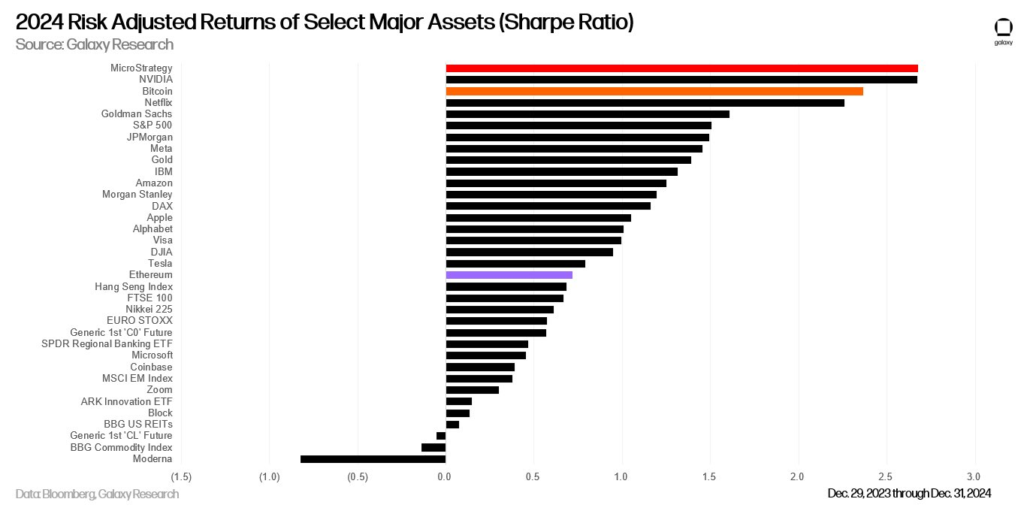

You can’t have returns without volatility. There’s no free lunch. The Sharpe Ratio is the risk-adjusted (adjusted for volatility) return of an asset over time. The higher the Sharpe Ratio, the higher the risk-adjusted return.

Two of the top three assets by Sharpe Ratio in 2024 were Bitcoin-related: MicroStrategy (MSTR) and Bitcoin itself. Are you paying attention yet?

Source: https://x.com/intangiblecoins/status/1874879710167195757

Tweets I’m Reading

"People who don't homeschool…their lives suck" @naval

— Joel Rafidi (@joelrafidi) January 22, 2025

Loved this conversation with @astupple and @naval on the @tferriss podcast. pic.twitter.com/TVI4llNVwz

Why Bitcoin? 🤔

— Preston Pysh (@PrestonPysh) January 23, 2025

Here's a 30 minute presentation I recently gave in NYC.

I decompress @saylor's 3 min pitch to @Microsoft among other important concepts. @egodeathcapital @1andipitt @nico_lechuga @MicroStrategy @LynAldenContact @JeffBooth pic.twitter.com/ub0LaSeipR

👀 Summarization prompt pic.twitter.com/GcBbLVFxZn

— Rohan Paul (@rohanpaul_ai) January 24, 2025

“The newest technical papers and the oldest books are the best sources of arbitrage. They contain the least popular facts and the most monetizable truths”, says Balaji Srinivasan.

— Reads with Ravi (@readswithravi) January 26, 2025

25 books recommended by @balajis:

1) The Princeton Companion to Mathematics by Timothy Gowers pic.twitter.com/SlbmTUUfLz

@JeffBooth sent this to me. He posted on NOSTR yesterday, and gave me permission to put it out on X on his behalf, as Jeff now posts almost exclusively on NOSTR. As you can imagine, I agree with Jeff’s assertions. I find I very rarely don’t. Thank you.

— Puncher75 (@Puncher522) January 26, 2025

JB: With all the…

If you have feedback for me, if something resonates and you want to see more of it, reply in the comments below. You can also tweet at me on Twitter @the_cody_hall.

I look forward to hearing from you!

If you’re not yet subscribed you can do so here: