This is post #5 in my series on money and Bitcoin. You can jump to the posts with these links:

- What is Money

- How Money Solves a Problem

- Five Characteristics of Money

- Three Functions of Money

- Money Rankings on a Quality Scale

- How Governments Control Money

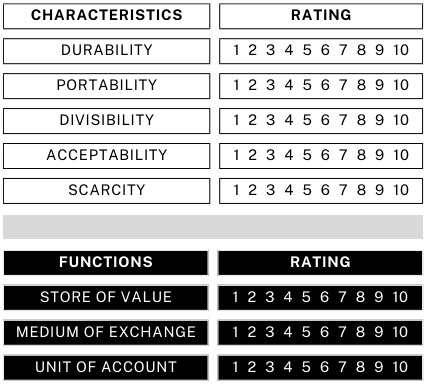

Money is a tool with five characteristics: durability, portability, divisibility, acceptability, and scarcity. In post #4, we saw that money has three different functions: store of value, medium of exchange, and unit of account.

I’ve made a rubric to help visualize how various monies compare. This point should be emphasized: all measurements or rankings are relative to other forms of money. There is no objective measure. This ranking is also somewhat subjective, though I trust you will see it is fair.

The Rubric

Let’s jump into a quality assessment of different monies and see what we learn.

Commodity Money

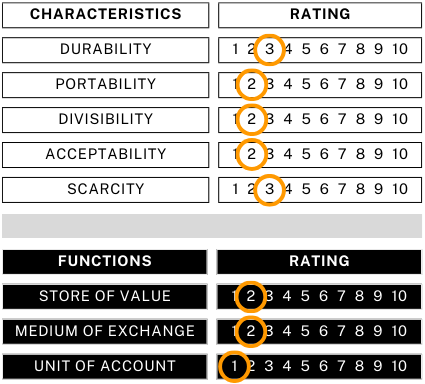

Livestock

For millennia, and still today,1 cattle, sheep, and other livestock serve as a form of wealth and a medium of exchange. Livestock are valuable for their utility in agriculture and food production. I have personally been to African countries where cattle are exchanged to settle family debts.

How does livestock rank as money?

Durability:

- Livestock, such as cattle, sheep, or goats, have a limited lifespan and are subject to disease, injury, and natural mortality.

- While they can be considered durable for a certain period, their durability as a currency is relatively low compared to more permanent forms of money like precious metals or modern fiat currencies.

- Rating: 3

Portability:

- Livestock is not very portable, especially over long distances or in large quantities.

- Moving a herd of animals requires significant effort, resources, and logistical considerations.

- Transporting livestock as a means of payment or exchange can be cumbersome and impractical, particularly in urban or densely populated areas.

- Rating: 2

Divisibility:

- Livestock can be considered divisible to some extent, as individual animals can be traded or exchanged.

- However, the divisibility is limited, as it is difficult to divide a single animal into smaller units of value.

- Fractional ownership or sharing arrangements may be possible, but they add complexity to the exchange process.

- Rating: 2

Acceptability:

- Livestock has been historically accepted as a form of payment or exchange in certain societies, particularly those with agrarian or pastoral economies.

- However, in modern economies, the acceptability of livestock as a currency is relatively low, as most people prefer more convenient and standardized forms of money.

- Acceptability may also vary depending on cultural and regional factors.

- Rating: 2

Scarcity:

- Livestock is a renewable resource, but its supply is not unlimited and can be affected by various factors such as climate, disease, and available grazing land.

- The scarcity of livestock can vary depending on the specific region or period but, in general, it is not as scarce as precious metals or other limited resources used as currency.

- Rating: 3

These low characteristic ratings inevitably produce low ratings in each of the three functions.

Characteristics Average – 2.4/10

Functions Average – 1.7/10

Womp womp womp…not so good.

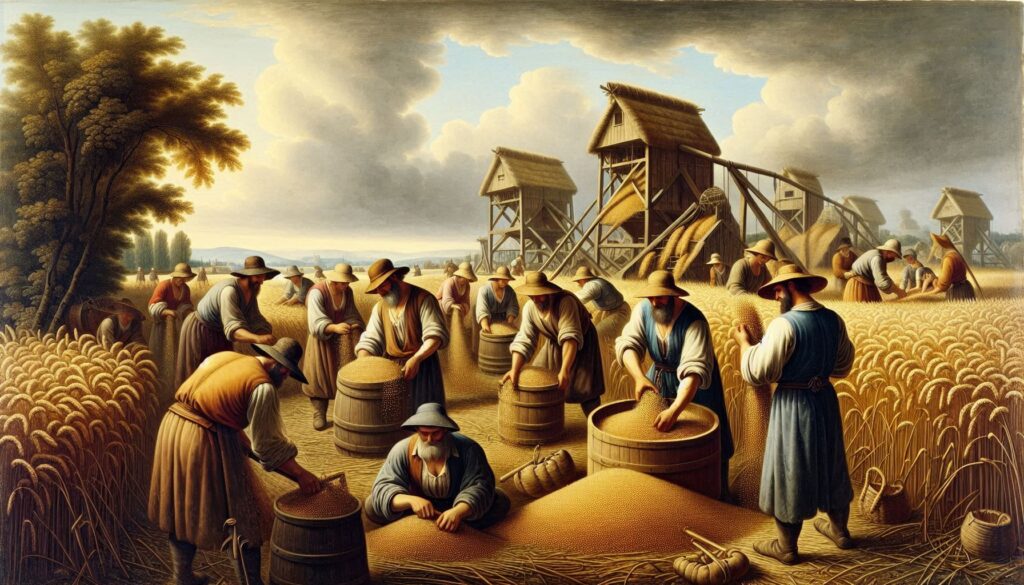

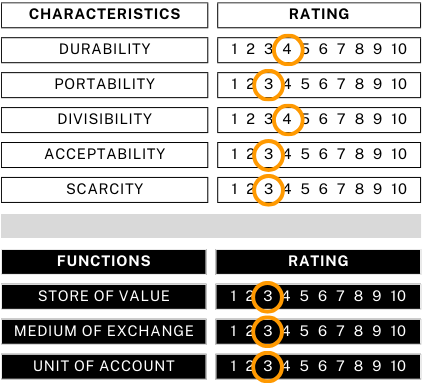

Grain

Grain has a rich history as a form of commodity money, particularly in agricultural societies. It also has been used for millennia.

Durability:

- Grain can be stored for extended periods if kept in proper conditions, but it is susceptible to spoilage, pests, and environmental factors.

- While more durable than livestock, it still has a limited shelf life compared to metals or modern currencies.

- Rating: 4

Portability:

- Grain is more portable than livestock, as it can be contained in sacks or other containers.

- However, transporting large quantities of grain still requires significant effort and resources.

- Its portability is limited compared to more compact forms of currency.

- Rating: 3

Divisibility:

- Grain is highly divisible, as it can be measured in various quantities (e.g., bushels, pounds, kilograms).

- It’s relatively easy to divide grain into smaller units for transactions of different values.

- Rating: 4

Acceptability:

- Historically, grain has been widely accepted as a form of payment in agricultural societies.

- In modern economies, its acceptability as currency is limited, though it may still be used in some rural or barter-based systems.

- Acceptability can vary based on the type of grain and regional preferences.

- Rating: 3

Scarcity:

- Grain is a renewable resource, produced seasonally through agriculture.

- Its supply can be affected by factors such as weather, crop yields, and cultivation practices.

- While not as scarce as precious metals, grain’s availability is not unlimited and can fluctuate.

- Rating: 3

Similar to livestock, these ratings produce low-to-moderate ratings in each of the three functions of money.

Characteristics Average – 3.4/10

Functions Average – 3/10

Slightly better than livestock but still nothing to write home about.

Coinage

Overall, coinage performs well across all five characteristics of money. This explains its enduring popularity and effectiveness as a form of currency throughout history and into the present day. From the Denarius in the Roman empire (approx. 27 BC – 476 AD) to the United States Penny (1793 – present), coins combine the intrinsic value of metals with the convenience of standardized units, making them quite functional.

Durability:

- Coins, especially those made from metals like gold, silver, or copper alloys, are highly durable.

- They can last for centuries without significant degradation, as evidenced by ancient coins found by archaeologists.

- Modern coins are designed to withstand daily use and circulation.

- Rating: 7

Portability:

- Coins are relatively small and lightweight, making them easy to carry and transport.

- Large sums can be more cumbersome due to weight, but still more portable than many commodity monies.

- Modern alloys have improved portability by reducing weight while maintaining value.

- Rating: 7

Divisibility:

- Coins come in various denominations, allowing for precise divisions of value.

- Different metals or alloys can represent different values.

- The ability to combine different coins allows for a wide range of transaction amounts.

- Rating: 7

Acceptability:

- Coins have been widely accepted across cultures and throughout history.

- Government backing often ensures acceptance within a country or region.

- Some coins (like gold) have had near-universal acceptance.

- In modern times, acceptability remains high, though electronic payments are increasingly preferred for larger transactions.

- Rating: 8

Scarcity:

- Precious metal coins (gold, silver) have natural scarcity.

- Base metal coins derive scarcity from controlled minting by governments.

- The scarcity can be managed to maintain value, though this requires responsible monetary policy.

- Rating: 8

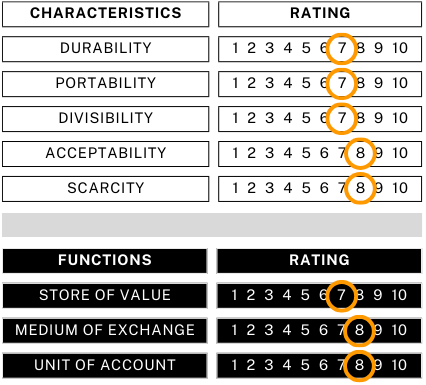

These good ratings produce moderate-to-high ratings in each of the three functions of money.

Characteristics Average – 7.4/10

Functions Average – 7.7/10

Coinage far outperforms commodity monies and enjoys global usage even today, although digital transactions have long been eating coinage’s lunch.

Coinage is more susceptible to both illegal counterfeiting and legal counterfeiting. Everyone knows about the former, but fewer know about the latter. Leaders and governments throughout history have debased coinage by trimming the edges of the coins and changing the metal alloy to reduce the amount of precious metal. This is only “legal” because the government is doing it, and the government has a monopoly on violence. The effect is the same: the coins people work hard to own are made less valuable through no fault of their own.

Paper Money

Paper money’s effectiveness as a currency is largely due to its convenience and the trust placed in the issuing authorities. This varies as a strength and weakness depending on the world’s confidence level in the issuing government. It allows for easy transactions of both small and large amounts (with an upper limit—try carrying $10,000 cash into another country), and its widespread acceptance makes it a highly functional form of money in modern economies.

Durability:

- Paper money is less durable than coins, but modern manufacturing techniques have improved its lifespan.

- It can be damaged by water, fire, or tearing, but is designed to withstand normal handling.

- Most central banks regularly replace worn-out notes.

- Rating: 5

Portability:

- Highly portable due to its lightweight and compact nature.

- Moderate sums can be carried easily, unlike heavy coins or commodity money.

- Rating: 8

Divisibility:

- Comes in various denominations, allowing for a wide range of transaction amounts.

- Smaller denominations enable precise divisions of value.

- Can be combined easily for larger sums.

- Rating: 7

Acceptability:

- Widely accepted within the issuing country due to government backing.

- Some currencies (e.g., US Dollar, Euro) are accepted internationally.

- Legal tender laws often require its acceptance for settling debts.

- Rating: 7

Scarcity:

- Scarcity is controlled by central banks through monetary policy.

- Not inherently scarce like precious metals, but supply is regulated.

- Overprinting can lead to inflation, reducing value.

- Rating: 6

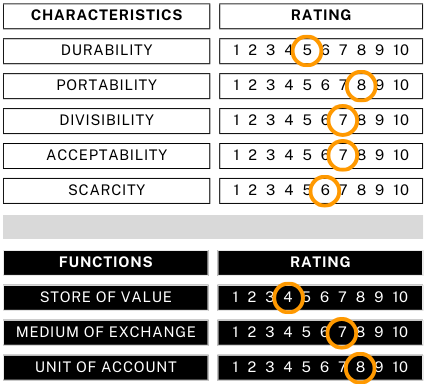

These good ratings produce moderately high ratings in each of the three functions of money.

Characteristics Average – 6.6/10

Functions Average – 6.3/10

Paper money is weak to counterfeiting (though security features have greatly improved) and depends on responsible monetary policy to maintain value. Like with coinage, governments can debase paper money by printing and circulating more of it than is being destroyed or removed due to damage. In the digital age, electronic forms of currency are increasingly out-competing paper money for everyday transactions.

Other Forms

Rai Stones

Rai stones were large stone disks used as a traditional form of currency on the island of Yap in Micronesia, presenting an interesting case for analysis.

Durability:

- Made of limestone, Rai stones are extremely durable and can last for centuries.

- They are resistant to weathering and environmental damage.

- Rating: 8

Portability:

- Rai stones are notoriously difficult to move due to their massive size and weight.

- Some stones are so large they aren’t moved at all; ownership is transferred verbally.

- This lack of physical portability is offset by the unique Yapese system of acknowledging ownership without moving the stone.

- Rating: 2

Divisibility:

- Rai stones are not physically divisible.

- Each stone represents a specific value, and this value cannot be easily split.

- However, ownership of a stone can be divided among multiple people.

- Rating: 1

Acceptability:

- Highly accepted within Yapese culture, where they have been used for centuries.

- Outside of Yap, they have little to no acceptance as currency.

- Rating: 2

Scarcity:

- Rai stones are naturally scarce due to the difficulty in creating and transporting them.

- They were traditionally quarried on other islands and brought to Yap with great effort.

- New stones are rarely, if ever, introduced into the system.

- Rating: 9

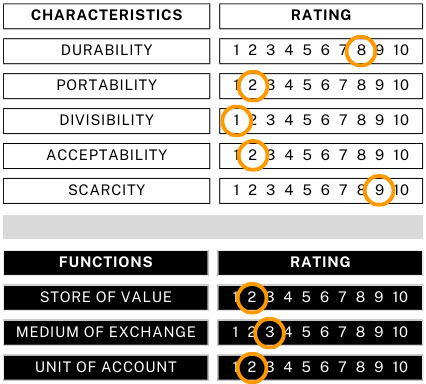

These widely varying ratings produce low ratings in each of the three functions of money.

Characteristics Average – 4.4/10

Functions Average – 2.3/10

Rai stones show that money adapts to specific cultural and geographical contexts. While they wouldn’t function as a global currency, they served effectively within Yapese society. Their use highlights the importance of communal agreement and trust in establishing the value of currency.

Rai stones’ use as an everyday currency has diminished with the introduction of modern money systems. However, they continue to be used for important ceremonial exchanges.

Bitcoin

Bitcoin is a decentralized digital currency that operates on a peer-to-peer network. It was introduced in 2008 by an anonymous creator known as Satoshi Nakamoto. Bitcoin’s design is public, no one owns or controls it, and everyone can participate in the network.

Durability:

- As a digital asset, Bitcoin is not subject to physical degradation.

- The blockchain technology ensures that transactions are permanently recorded and the currency can’t be destroyed.

- However, access to Bitcoin can be lost if private keys are misplaced or destroyed.

- Rating: 9

Portability:

- Extremely portable as it exists in digital form.

- Can be transferred globally almost instantly with internet access.

- No physical transportation required, regardless of the amount.

- Rating: 10

Divisibility:

- Highly divisible, up to 8 decimal places (0.00000001 BTC, known as a “satoshi”).

- This allows for micro-transactions and fine-grained value transfer.

- Rating: 10

Acceptability:

- Acceptance has grown significantly since its inception, but is not universal.

- Some businesses and online platforms accept Bitcoin, but it’s not widely used for everyday transactions in most places.

- Regulatory concerns in some countries limit its acceptability.

- Rating: 7 (and growing)

Scarcity:

- Built-in scarcity with a maximum supply cap of 21 million bitcoins.

- New bitcoins are created at a predetermined and gradually decreasing rate.

- This scarcity is a key feature of its design.

- Rating: 10

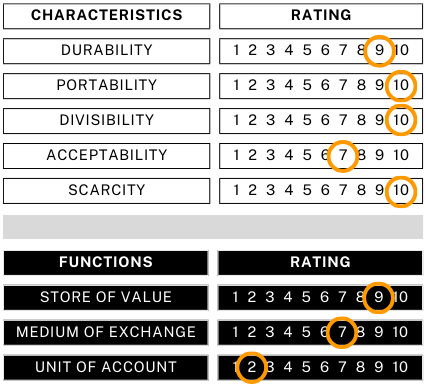

Overall, Bitcoin performs moderately well in the functions of money, except as a unit of account. Adoption is still only a fraction of what would be needed for Bitcoin to serve as a unit of account.

Characteristics Average – 9.2/10

Functions Average – 6/10

The main challenge for Bitcoin is its acceptability. While it has gained recognition and adoption, it’s not yet universally accepted as a means of payment. Its value in US dollars can also be highly volatile over short windows of time, which affects its reliability as a short-term store of value and medium of exchange.

Bitcoin represents a new paradigm in currency, leveraging technology to address some limitations of traditional money. Its role in the global financial system is still evolving and faces uncertainty in regulation and scalability. As with any relatively new and transformative technology, Bitcoin’s long-term viability depends on ongoing technological development, regulatory frameworks, and broader societal adoption.

Summary

Various forms of money can be ranked based on their characteristics and how well they execute each of the three functions of money. Limited spheres of use mean that ranking money is difficult. Rai stones were the only currency for the Yapese in Micronesia, but never functioned as money on a larger scale. Bitcoin is only 16 years old and has only a fraction of the adoption that the US Dollar has.

I’m arguing that, over time, the inherent qualities of each form of money will determine how widely it is adopted. Thiers’ Law states that, under normal market conditions without price controls, good money drives out bad money.2 People prefer to use and hold the most stable and valuable currency available.

In reality, where governments all over the world are interfering in the “free” markets, Gresham’s law is also applicable. It states that when there are two forms of commodity money in circulation that are required to be accepted as legal tender at equal face value, “bad money drives out good.”3 The less valuable money tends to be used for transactions while the more valuable money is hoarded or taken out of circulation.

Future posts will look at the impact governments have on the money used within their borders, a deeper dive into the Bitcoin network, and some implications for churches and gospel-focused ministries that adopt Bitcoin.

1 https://www.perplexity.ai/search/Are-cattle-still-LjubWh.tRrC8KrVf6e46cg

2 https://en.wikipedia.org/wiki/Gresham%27s_law

3 Ibid.

This is post #5 in my series on money and Bitcoin. You can jump to the other posts here: